eToro comments on the publication of the Halifax UK House Price Index

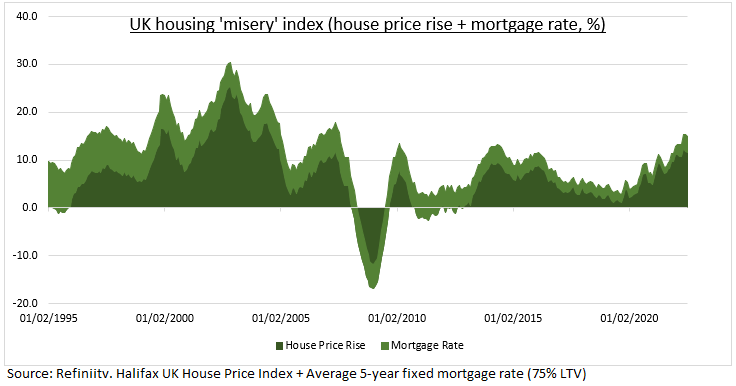

Ben Laidler, Global Markets Strategist at social investment network eToro, comments on publication of Halifax UK House Price Index, which shows UK housing ‘misery’ is at the highest in 15 years.

“The Halifax UK house price index eased back for the third month to 11.5% growth, under the weight of rising interest rates and the cost-of-living crisis. The average UK house now costs £293,000.

“The eToro UK housing ‘misery index’ remains at very high levels not seen since 2007. The combination of still double-digit house price growth (11.5%) and doubled mortgage rates (3.45%) is a big problem for many. New buyers struggle to get on the housing ladder. Whilst rental prices are indirectly pushed higher.

“A soft housing landing is key to the UK economic outlook, as the Bank of England readies to further accelerate interest rate rises to 0.75% at its meeting next week. Housing is the biggest asset for the 65% of the population who own their house, but also by far the largest component (31%) of the inflation basket.”

Kindly shared by eToro

Main article photo courtesy of Pixabay