Average house price rises for eleventh consecutive month, but overall pace slows – Halifax House Price Index

Average house price rises for eleventh consecutive month, but overall pace slows, according to the latest Halifax House Price Index, covering May.

Key points from publication:

- House prices increased by 1.0% in May, the eleventh consecutive monthly rise

- Average house price record set again, now £289,099

- Northern Ireland and the South West top for annual house price inflation

- Annual house price inflation edges down, although remains in double-digits

- House prices have risen 74% in the last 10 years

| Average house price

£289,099 |

Monthly change

+1.0% |

Quarterly change

+3.2% |

Annual change

+10.5% |

Russell Galley, Managing Director, Halifax, said:

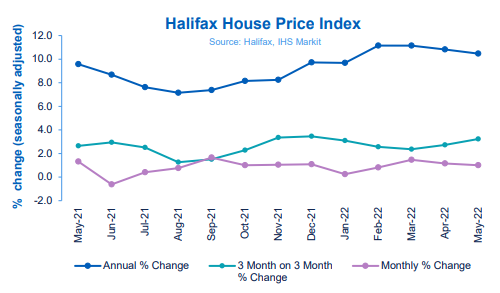

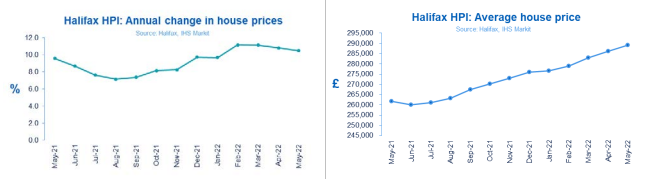

“The average cost of buying a home in the UK is up 1%, or £2,857, on last month, and has now risen for eleven consecutive months. Annual growth also remains in double-digits, at 10.5%, although this is the slowest rate of growth seen since the start of the year.

“The average cost to buy a home in the UK is now £289,099, hitting yet another record high. Despite the very real cost of living pressures some people are experiencing, the imbalance between supply and demand for properties remains the primary reason driving the continued climb in house prices.

“For house-hunters, the extent of the impact of property price inflation continues to be linked to the type of home they are looking to buy. Compared to May last year, you’d need around £10,000 more to buy a flat, but an additional £50,000 for a detached home. This clearly creates a knock-on effect for those looking to make their first home move, as the rungs on the housing ladder have become increasingly wider.

“However, the housing market has begun to show signs of cooling. Mortgage activity has started to come down and, coupled with the inflationary pressures currently exerted on household budgets, it’s likely activity will start to slow.

“So, there is perhaps one green shoot for prospective purchasers; with overall buying demand down compared to last year, we may be past the peak sellers’ market.”

Regions and nations house prices:

Northern Ireland topped the table again this month for annual house price inflation, seeing prices rise by 15.2%, equating to an average of £185,386.

The South West of England also recorded a strong rate of annual growth at 14.5%, with an average property cost of £305,173, alongside Wales at 13.7%, where a home is a now a record of £216,120.

Overall, nine regions of the UK registered double-digit annual inflation, with only Yorkshire and the Humber, Scotland and London in single figures. Nonetheless, buying a home in the capital today would still require £541,942, on average.

In Scotland, growth continues to underperform relative to the UK average, with annual inflation at 8.3%. A home in the country now costs an average £198,288.

A decade of house price growth:

Over the past decade, the cost of a home has risen by 74%, or by £123,016. The strongest inflation has been in London (84.2%), followed by the East of England (84.0%) and the East Midlands (82.1%). In cash terms, London house-hunters need £247,638 more than those looking ten years ago, whereas those in the East of England need £153,930 and the East Midlands £108,116.

The relative under-performance – compared to the UK average – of London in 2022 is in stark contrast to ten years prior. In May 2012, the capital was performing better than anywhere else in the UK, with annual house price inflation of 4%. Overall, the South was leading a recovery in property prices following the recession of 2008 and 2009, with the South East (2.5%) and East of England (1.7%) the next best performers.

In some regions the picture in 2012 contrasts sharply to [the one] today. A decade ago, Northern Ireland had experienced a house price fall of 9.6% year on year, with the Welsh market seeing a drop of 1.2%.

Housing activity:

- HMRC monthly property transactions data shows UK home sales decreased in April 2022. UK seasonally adjusted (SA) residential transactions in April 2022 were 106,780 – down by 3.9% from March’s figure of 111,150 (down 10.5% on a non-SA basis). Quarterly SA transactions (February-April 2022) were approximately 8.8% higher than the preceding three months (November 2021-January 2022). Year-on-year SA transactions were 12.1% lower than April 2021 (13.9% lower on a non-SA basis). (Source: HMRC)

- Latest Bank of England figures show the number of mortgages approved to finance house purchases fell in April 2022, by 5.1% to 65974. Year-on-year the April figure was 23% below April 2021. (Source: Bank of England, seasonally-adjusted figures)

- In the latest RICS Residential Market Survey, a net balance of +10% respondents cited an increase in new buyer demand during April – an eighth consecutive month in positive territory (previously +9%). Agreed sales and new instructions returned to negative territory with balances at -2% (previously +7%) and -1% (+8% previously) respectively. (Source: Royal Institution of Chartered Surveyors’ (RICS) monthly report

UK house prices – Historical data:

National: All Houses, All Buyers (Seasonally Adjusted)

| Period | Index

Jan 1922=100 |

Standardised average price

£ |

Monthly change

% |

Quarterly change

% |

Annual change

% |

| May 2021 | 451.3 | 261,709 | 1.3 | 2.6 | 9.6 |

| June | 448.5 | 260,099 | -0.6 | 2.9 | 8.7 |

| July | 450.4 | 261,165 | 0.4 | 2.5 | 7.8 |

| August | 453.8 | 263,162 | 0.8 | 1.3 | 7.2 |

| September | 461.3 | 267,516 | 1.7 | 1.5 | 7.4 |

| October | 465.9 | 270,184 | 1.0 | 2.3 | 8.2 |

| November | 470.8 | 273,028 | 1.1 | 3.4 | 8.2 |

| December | 475.9 | 275,996 | 1.1 | 3.5 | 9.7 |

| January 2022 | 477.0 | 276,645 | 0.2 | 3.1 | 9.7 |

| February | 480.9 | 278,894 | 0.8 | 2.6 | 11.2 |

| March | 488.0 | 283,001 | 1.5 | 2.4 | 11.1 |

| April | 493.6 | 286,242 | 1.2 | 2.7 | 10.8 |

| May | 498.5 | 289,099 | 1.0 | 3.2 | 10.5 |

Kindly shared by Halifax

Main article photo courtesy of Pixabay