Equity release activity climbs 24% year-on-year to £4.8bn as market returns to growth

The Equity Release Council publishes its Q4 and full-year 2021 lending figures, showing equity release activity climbs 24% year-on-year to £4.8bn as market returns to growth.

Key points from publication:

- Record amounts of property wealth were accessed via equity release products in Q4 and across 2021 by more than 76,000 new and returning customers, according to the Equity Release Council.

- Its figures show the sector has not only maintained its resilience throughout the uncertainty of the pandemic but has now returned to growth for the first time since 2018.

- Total lending to homeowners aged 55+ via lifetime mortgages and home reversion plans grew by 24% year-on-year, compared with 31% lending growth across the wider mortgage market.

- Average loan sizes also increased, partly influenced by rising property prices and an increase in wealthier customers using equity release as part of their financial planning.

David Burrowes, Chairman of the Equity Release Council, comments:

“Cost of living pressures are just one of many reasons why homeowners are choosing to cash in on years of wealth accumulated in their homes. Increasing loan sizes partly reflect the rise in house prices and a more affluent type of customer using lifetime mortgages to plan their finances or gift a living legacy to family members.

“Having proved itself to have solid foundations through a period of uncertainty, the equity release market’s return to growth has just as much to do with trust and innovation as it does with external factors as households look to manage their finances in later life.

“Equity release products have continued to evolve in recent years with new providers and features adding to their appeal. Increasingly flexibility has brought lifetime mortgages closer to their residential equivalents, by offering capital or interest payment options alongside long-term, time-honoured protections against rising interest rates and negative equity.”

Key statistics for Q4 2021 and FY 2021 – Overall activity:

- The number of new and returning equity release customers served in Q4 reached 19,975, up from 19,300 in Q3 2021 and 19,333 in Q4 2020.

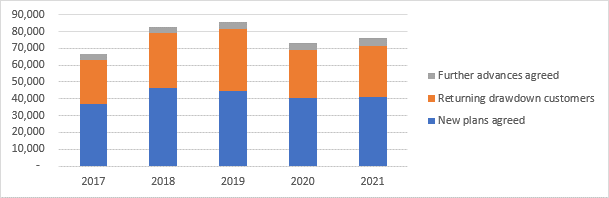

- For the year as a whole, 76,154 customers took out new equity release plans, made use of drawdown reserves or agreed extensions to existing plans. This was a 4% increase year-on-year from 72,988, although it remains below the peak of 85,497 seen in 2019 [see graph 1].

- Customers borrowed £1.34bn of property wealth via equity release products from October to December, including £1.2bn via new plans and £153m via drawdowns or further advances. This makes Q4 2021 the busiest on record for lending activity, surpassing the £1.17bn recorded in Q2.

- Total lending of £4.8bn for 2021, including £4.3bn via new plans and £500m to returning customers. This represents a 24% rise from £3.86bn in 2020 at a time when wider lending across the mortgage market grew 31%.

- Annual equity release lending surpassed the previous record set in 2018 (£3.94bn), influenced by factors including growing choice and competition in the market, customers seeking additional sources of funds for later life, and the strong performance of the UK housing market with the average house price increasing by £25,000 in the year to November 2021.

Key statistics for Q4 2021 and FY 2021 – Trends among new customers:

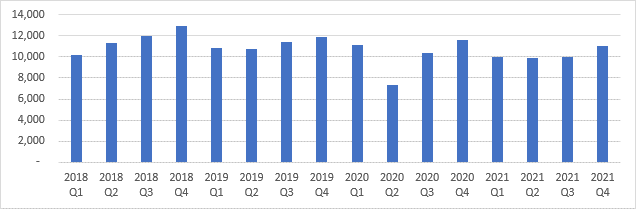

- A total of 11,013 new plans were agreed between October and December 2021. This made Q4 the busiest quarter of 2021, reflecting normal seasonal patterns, and the second busiest of the Covid-19 pandemic period after Q4 2020 when 11,566 new plans were agreed [see graph 2].

- Overall, 2021 saw 40,964 new plans agreed, an increase of 2% from 40,337 in 2020 despite remaining below the levels recorded in 2018 (46,397) and 2019 (44,870).

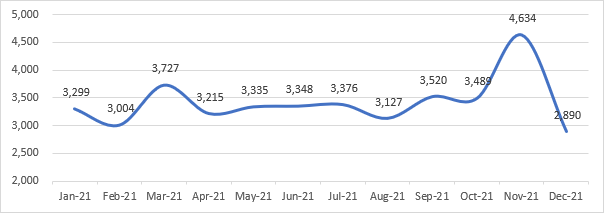

- November was the busiest month of 2021 for new plans agreed (4,634), compared with an October peak during 2020 (4,164). Activity then slowed in December with 2,890 new plans taken out, making it the quietest month of the year [see graph 3].

- Three in five new customers (61%) opted for drawdown lifetime mortgages in Q4, the highest percentage of the year and up from 59% in Q4 2020.

- Lump sum lifetime mortgages made up 43% of new plans agreed across the whole of 2021, matching the figure recorded in 2020 which was the largest annual share of market activity since 2009 (44%). This may be influenced by customers with existing residential mortgages, including interest-only loans, reaching maturity in later life.

- New customers taking out drawdown plans in Q4 increased their total borrowing by 18% compared with Q4 2020, with an average of £96,699 taken up front and £35,532 reserved for future use. New lump sum plan sizes have grown 20% over the same period to £125,911.

- New customers agreed similar amounts of borrowing via drawdown and lump sum products during 2021. The average lump sum plan was £124,990, while the average drawdown plan featured an up-front amount of £89,786 with £34,950 held back for future use, making £124,735 in total.

Key statistics for Q4 2021 and FY 2021 – Trends among returning customers:

- Q4 2021 saw 7,571 existing customers with drawdown lifetime mortgages make use of their agreed reserves. This a slight drop from Q3 (down 5%) from 6,697 in Q3 but represented a bounce-back from a subdued Q4 last year, with activity volumes increasing 11%.

- The average instalment taken by returning drawdown customers was £12,501 in Q4, up from £11,476 in Q3.

- Across 2021 as a whole, 30,521 returning drawdown customers made use of the ability to draw funds from their agreed reserves, up from 28,902 in 2020 but short of the 36,426 seen in 2019.

- Further advance activity also increased in Q4 2021, with 1,391 extensions agreed to existing equity release plans. This compares to 1,275 in Q3 2021 and 975 in Q4 2020.

- For the full year, 4,669 customers agreed extensions to their existing plans, which may reflect the fact that rising house prices have given some homeowners more equity to draw on.

Market data – Graph 1: Total equity release customers served annually, 2017-2021

Market data – Graph 2: New equity release plans agreed per quarter, 2018 to 2021

Market data – Graph 3: New equity release plans agreed per month, 2021

About the data

The Equity Release Council’s market statistics are compiled from member activity, including all national providers in the equity release market. This latest edition was produced in January 2022 using data from customer activity during the fourth quarter of last year (October to December). All figures quoted are aggregated for the whole market and do not represent the business of individual member firms.

Equity release products are available to homeowners aged 55+, enabling them to release money from the value of their home following a regulated process of financial advice and independent legal advice to determine whether this is suitable for their individual circumstances and long-term needs. Funds released are typically used for a range of purposes including providing additional retirement income, funding one-off expenses and lifestyle purchases, consolidating debts, meeting homecare costs and gifting a ‘living inheritance’ to family or friends.

For a comprehensive list of members, please visit the Council’s online member directory.

Kindly shared by Equity Release Council (ERC)

Main article photo courtesy of Pixabay