Industrial rents reach new highs as the demand for space surges

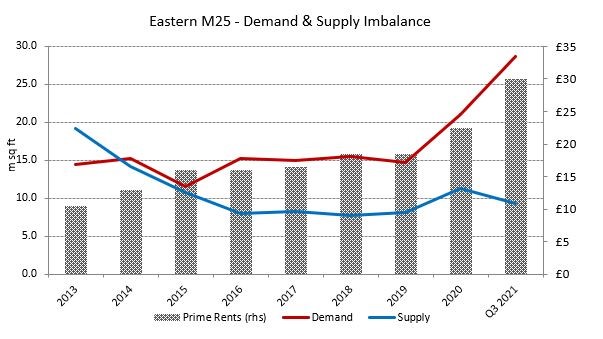

The first three quarters of 2021 have seen an unprecedented surge in demand for industrial rents and floor space in the Eastern M25 market as the economy recovers from the impacts of the pandemic.

Glenny’s latest research on the key market which acts as a major artery into the London economy has shown that demand accelerated to 28.6m sq. ft. pushing rents to record levels, having reach £30 per sq. ft. in the key East London market.

John Bell, Head of Business Space at Glenny comments on the latest research and the promising start to this year:

“Our latest research has illustrated the important role that the Eastern M25 market is going to play in the ‘opening up of the London economy. There are 9.4m people in Greater London and the Eastern M25 provides a vital link between London and the rest of the world. Goods coming into London Gateway need to be quickly transported to their final destinations.”

Following a relatively slow start to the year, with the economy still in the midst of the third lockdown, the second and third quarters have seen an acceleration in take up with the year to date figure now standing at 5.8m sq. ft. and the full year figure set to reach 8.0m sq. ft. for the second successive year.

Bell adds:

“We have seen another exceptional year in our region and the latest demand figures point to a continuation of this trend. The demand for space is being boosted by on line shopping but also companies who need to revisit their supply chains in the light of supply shortages as the economy continues to get back to full speed. There is a real need for new supply to be delivered into this market in order to maintain the capital’s economic recovery.”

This point is re enforced by the fact that supply has now returned to levels last seen before the pandemic. Of the total 9.3m sq. ft. on the market only 1.9m sq. ft. is in grade A space. What is even more poignant is there are no new Big Box units in the Eastern M25 and demand from this sector of the market now stands at 12.7m sq. ft.

Bell concludes:

“The next 12-18 months should see a number of new schemes coming forward providing much needed solutions for larger distribution and logistics operators. This market is severely under supplied, as was evidenced by Made.com’s 387,000 sq. ft. expansion at London Gateway and Ikea’s acquisition of the 450,000 sq ft Powerhouse in Dartford ahead of completion. There are very few alternatives to providing good routes into the London market.”

Offices

The Eastern M25 office market continued to show signs of recovery as workers returned to the office after the pandemic. Demand for space moved to record levels, with a total of 3.7m sq. ft. of requirements registered at the end of Q3 2021.

Contrary to belief, the major focus of demand has been in the Greater London market, with businesses still looking to locate in London in preference to following the satellite office model approach that gathered traction during the pandemic.

Supply, particularly of larger buildings, is focused in the East London and Docklands market and this should act as a major magnet for occupiers.

Kindly shared by Glenny

Main photo courtesy of Pixabay