Inflation jumps to pre-pandemic levels, but there’s no need to panic

Sarah Coles, personal finance analyst at Hargreaves Lansdown, comments on the ONS’s publication of the Consumer Price Index for April, which shows Inflation jumps to pre-pandemic levels, but that there is no need to panic.

Key points from Index:

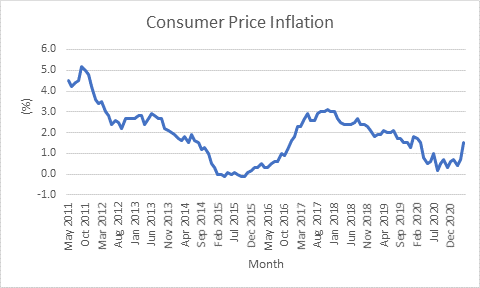

- The Consumer Price Index measure of inflation was 1.5% in April (up from 0.7% in March).

- The biggest sectors pushing prices up were petrol and diesel (up 13.6% in a year), household utility bills (the price cap rose 9% in April) and clothes (which have been all over the shop during the pandemic).

- Petrol was up 1.8p to 125.5 pence per litre in April 2021, compared with a fall of 10.4p to 116 pence per litre in April 2020 (the biggest monthly fall since the price of this kind of fuel was first measured in 1990).

Sarah Coles comments:

“Inflation has jumped 1.5% in the year to April, up from 0.7% a month earlier. It’s yet more dreadful news for savers, who can no longer beat inflation in any standard savings account, and it won’t ease inflation anxiety, which spooked the markets last week, but it’s still way too early to be sounding the alarm.”

The risers

“Higher inflation was always on the cards for this spring. This time last year, the oil price was at rock bottom. The world ground to a halt, so had little need for it, but a price war between Russia and Saudi Arabia meant they didn’t put the brakes on supply. It meant the price of petrol on the forecourt fell through the floor last April. The recovery in the intervening year means fuel prices are up 13.6% – the biggest annual rise for four years.

“The drop in the wholesale price of energy means that last April, the price cap on standard utility tariffs was cut back. By contrast, the wholesale gas price has been soaring more recently, and is up fivefold in a year. It means April 2021 saw the price cap jump 9% for the 11 million households still on standard tariffs, and prices returned to pre-pandemic levels.

“The cost of clothes, meanwhile, is all over the shop. This year retailers made unusually big cuts in the first three months of the year in order to shift stock during the most recent lockdown, and then pushed prices back up 2.4% in April. A year earlier they were still heavily discounting as lockdown continued, so they fell 1.5% in the same period.”

What next?

“Investors were stressed last week by the thought that we could be set for a period of higher inflation. This could in turn mean higher interest rates, which could make life harder for every business and household that has been borrowing its way through the crisis.

“Inflation isn’t going to ease in the immediate future, because the oil price hit a low point in May 2020. Meanwhile, the economy is still on course to reopen, and supply problems caused by both the pandemic and Brexit are pushing prices up. The Bank of England has forecast we’ll be over the 2% target soon.

“The Bank has been quick to reassure the markets this will be a temporary phenomenon, which will drop back when the oil price dip falls out of the figures. But there are no guarantees. We saw during the financial crisis that the bank can pump billions of pounds into the economy without sparking runaway inflation, but this time round it has been accompanied by record government spending, so there remains a risk that once we’re back on an even keel, pent up savings could be released, which would fuel inflation.”

What this means for savers

“If the Bank is right, and this is just a blip, it won’t raise interest rates to bring inflation down, and only expects modest rises once the economy is back on its feet. This would be positive news for borrowers, but another horrible blow for savers. Already we can’t match inflation with standard savings accounts – even if we tie our money up for seven years. It means we need to work harder to keep pace with inflation.

“Easy access savings still play a vital role for 3-6 months’ worth of essential expenses, but if our cash is in a high street savings account paying 0.01%, we need to get moving. There’s also every sign that savers are gravitating to easy access savings for all their cash, when we should really consider tying up money we won’t need over the next year in fixed rate accounts, in order to lock in a better rate. For money we plan to hold for 5-10 years or more, we need to at least consider investment, which will rise and fall over the short term, but over the long term stands a far better chance of staying ahead of inflation.”

Kindly shared by Hargreaves Lansdown

Main photo courtesy of Pixabay