First sign of Stamp Duty Holiday cliff edge emerges

Average house prices in England and Wales will fall by 4.1% in April 2021 in the first clear glimpse of the stamp duty holiday cliff edge and its impact on the value of deals already agreed by buyers and sellers, according to the latest reallymoving House Price Forecast.

Headlines from Forecast:

- House prices will drop sharply in April 2021 following the end of the Stamp Duty holiday

- Values appear to be falling back in line with spring 2020 as recent price inflation reverses

- Factoring in the cost of stamp duty, buyers doing deals in January have agreed to pay less

As the likelihood of meeting the deadline has decreased, so have prices, with buyers in January clearly factoring in the cost of a stamp duty bill, reducing their affordability and the price they’re willing to pay.

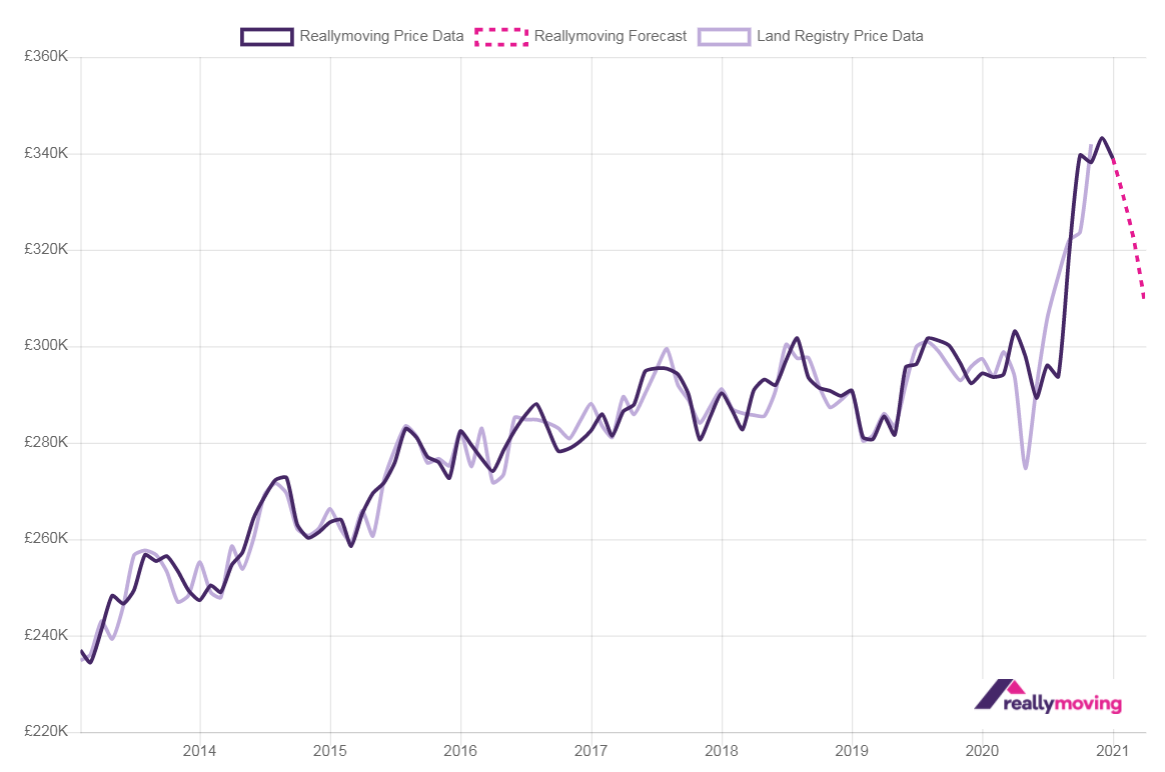

Reallymoving captures the purchase price buyers have agreed to pay when they search for conveyancing quotes through the comparison site, typically 12 weeks before they complete. This enables reallymoving to provide a three- month house price forecast that historically has closely tracked the Land Registry’s Price Paid data, published retrospectively (see graph below).

House prices are rapidly readjusting back down to levels seen twelve months ago, as the stamp duty holiday end looms and the post-lockdown rush to move home subsides. Following the Christmas peak, the new year downward trend in prices is accelerating as we head towards spring, with prices falling by 2.5% in February, 2.6% in March and 4.1% in April 2021.

The impact of the stamp duty holiday end is now clearly visible in the value of deals being agreed between buyers and sellers in January. Those that agreed deals earlier and may not complete in time are likely to attempt to renegotiate, or split the cost across the chain, further impacting prices although this won’t become evident until Land Registry Price Paid data is published.

In addition, consumer confidence is being impacted by uncertainty over the end of the current national lockdown – and concern over job losses when the furlough scheme finally ends.

Following a sharp fall in the proportion of First Time Buyers in the market in the second half of 2020, squeezed out by rising prices, a lack of high LTV finance and competition from buy to let investors taking advantage of the stamp duty holiday, we expect to see some resurgence in First Time Buyer activity later in the spring and early summer. Having held off for the past twelve months, many First Time Buyers will be tempted by deflating prices and the launch of the new Help to Buy scheme which is accessible only to them, making it easier to secure a property. Low-cost and accessible borrowing remains a barrier, although there are positive signs of lenders warming towards high LTV loans. According to Moneyfacts, there are now 197 mortgage produces available for buyers with a 10% deposit, compared to just 44 in September 2020.

Rob Houghton, CEO of reallymoving, comments:

“Now, for the first time, we can see the early impact of the end of the stamp duty holiday on prices, with buyers in January agreeing to pay less as they factor in the cost of a tax bill.

“Others who agreed deals earlier will still be hoping to make the deadline, and it’s likely we’ll see a sharp rise in fall- throughs in early April, as well as gazundering, which could impact final sale prices further if sellers are agreeable to spreading the cost – and many will be, rather than see their deal fall flat. Transparency and openness are key, and rather than hoping for the best, practical buyers and sellers will be opening up conversations now to try and ensure they can still proceed if they fail to complete by 31st March.

“The lending landscape continues to be challenging for First Time Buyers and home movers with less equity, but there have been several announcements in recent weeks of lenders returning to 90% loans and abandoning unnecessary restrictions on gifted deposits, which is encouraging. Prices falls are painful for some, but necessary to reverse the artificial spike in growth we saw in the second half of last year and tempt First Time Buyers back to the market, which is essential for its long-term health.”

Kindly shared by reallymoving.com

Main article photograph courtesy of Pixabay