Equity Release Council: Q2 2021 equity release market statistics

The Equity Release Council has today (29 July) published its equity release market statistics report for Quarter 2 of 2021.

Report headlines:

- 20,352 new and returning customers accessed property wealth between April and June, edging closer to pre-pandemic activity levels as consumer confidence holds

- Drawdown lifetime mortgages remained the most common type of new plan agreed (55%), although more customers took out lump sums in June before the £500,000 Stamp Duty holiday ended

- Returning drawdown figures picked up the most during Q2 after many existing customers paused withdrawals in 2020

- Over-55 homeowners unlocked £1.17bn of property wealth in total during Q2 2021, up 2% from Q1 (£1.14bn) and up 67% (£698m) since a subdued Q2 last year during the first Covid-19 lockdown.

David Burrowes, Chairman of the Equity Release Council, comments:

“Judging by these latest figures, the equity release market is showing signs of stability and durability as the option to access property wealth opens doors for thousands of people to pursue their financial goals.

“We were accustomed to more than 20,000 new or returning customers releasing equity each quarter in the two years before Covid-19 struck. We’re now seeing activity levels steadily returning back to that status quo, with some existing customers returning to make withdrawals that were put on hold last year. The gradual recovery suggests people are carefully weighing up their circumstances and long-term needs, helped by specialist financial and legal advice, with speculation about a spike of activity during the pandemic so far proving unfounded.

“The steady recovery has been helped by confidence in the wider property market, where house price gains over the last year have given many homeowners more equity at their disposal. Equity release has become a socially important means for one generation to help another, as well as meeting later life financial needs. June’s Stamp Duty deadline will have prompted some older homeowners to pass on a ‘living inheritance’ so that younger family members can climb the property ladder.”

Key statistics for Q2 2021 – Overall activity:

- Over-55 homeowners accessed £1.17bn of property wealth in Q2 2021. This was up 2% from £1.14bn in Q1 2021 and up 67% year-on-year from Q2 2020 during the first Covid-19 lockdown.

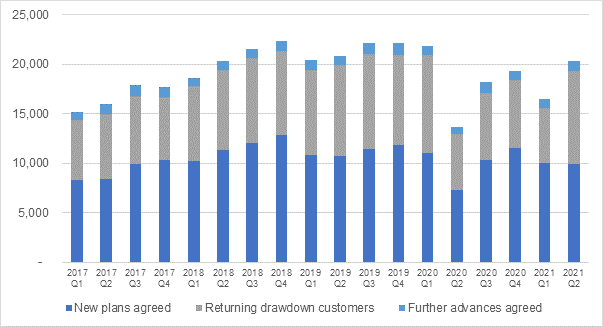

- A total of 20,270 new and returning customers were served between April and June as the market edged back towards pre-pandemic levels of business. This is a rise from 16,527 in Q1 2021 and 13,617 in Q2 2020 when households and employers were adjusting to pandemic conditions. The latest figure compares with an average of 21,036 customers served per quarter in 2018 and 2019 [see graph 1].

- Returning drawdown activity made the strongest recovery of any segment compared with Q2 2020 with customer numbers up 67%, having been the most subdued part of the market during the pandemic.

Key statistics for Q2 2021 – Trends among new customers:

- Customers agreed 9,898 new equity release plans in Q2 2021, slightly down from 10,030 in the previous quarter. This latest figure was the lowest since the first lockdown of Q2 2020 saw just 7,341 new plans agreed but remained broadly in line with the quarterly average for the first year of the pandemic (9,822).

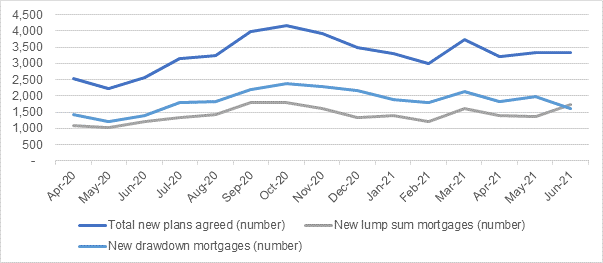

- Drawdown lifetime mortgages remained the most popular option with new customers (55%), while 45% opted for a lump sum lifetime mortgage.

- June was the busiest month for new plans agreed during Q2 (3,348), and the first month for more than a year that saw more lump sum than drawdown plans agreed (1,726 vs. 1,621). This is likely to be influenced by older customers releasing equity to help younger generations fund a house move ahead of the £500,000 Stamp Duty holiday deadline in June, or using equity release to move home themselves. [see graph 2]

- The average first instalment of a new drawdown lifetime mortgage was £86,349, reduced by 4% from Q1 (£89,758). The average new lump sum lifetime mortgage edged up slightly by 5% from Q1 to reach £129,558, with this increase likely to be influenced by increasing property values and instances of gifting in advance of the Stamp Duty deadline.

Key statistics for Q2 2021 – Trends among returning customers:

- Q2 2021 saw 9,382 existing customers with drawdown lifetime mortgages return to make a withdrawal from their agreed reserves. This was up from 5,566 in Q1 and 5,608 in Q2 2020.

- This marked a return to near pre-pandemic levels of activity in this part of the market, with returning drawdown numbers having been subdued for most of the last year as existing customers paused extra withdrawals. The first 12 months of operating under pandemic conditions saw just 24,663 returning drawdown customers compared with 37,660 in the previous 12 months.

- Further advances were agreed for 1,072 plans between April and June 2021, as customers sought to unlock additional property wealth. This was again reflective of pre-pandemic trends, with 1,057 further advances having been agreed per quarter in the year before the Covid-19 outbreak.

Market data

Graph 1: Equity release customers numbers, by type of customer, Q1 2017 to Q2 2021

Source: Equity Release Council

Graph 2: New equity release plans agreed per month, April 2020 to June 2021

Source: Equity Release Council

About the data

The Equity Release Council’s market statistics are compiled from member activity, including all national providers in the equity release market. This latest edition was produced in July 2021 using data from customer activity during the second quarter of the year (April to June). All figures quoted are aggregated for the whole market and do not represent the business of individual member firms.

Kindly shared by The Equity Release Council (ERC)

Main photo courtesy of Pixabay