A buyer’s market in March with record house-sales under asking price

It was a buyer’s market in March, because there was a record number of homes, which were sold for less than the original asking price.

- 86 per cent of properties sold for less than asking price in March

- The number of properties available to buy rose to the highest level since October 2017

- Demand for housing dropped marginally

- Sales to first-time buyers fell in March

- NAEA Propertymark issues March Housing Report1

It was a buyer’s market in March

- Almost nine in ten (86 per cent) properties sold for less than the asking price in March, the highest level seen since records began in 2013

- This is an increase of 12 percentage points from February when 74 per cent of sellers accepted offers below their original asking price

- Further, only one in 10 properties (10 per cent) sold for the original asking price in March, the lowest since records began.

Demand for housing

- The number of house-hunters on estate agents’ books fell marginally in March – from 309 registered per branch in February, to 308

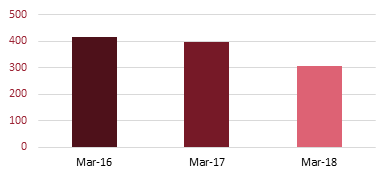

- Year-on-year, demand for housing is down by 22 per cent, as agents registered 397 house-hunters per branch in March 2017 and 417 in 2016 [ see figure 1].

Figure 1: Number of house-hunters year-on-year

Supply of properties

- The number of properties available per branch increased from 35 in February, to 40 in March – the highest since October last year.

Sales to first-time buyers (FTBs) and sales per branch

- Despite sales to FTBs rising last month following the Chancellor’s introduction of the stamp duty relief for those purchasing their first homes, sales to the group fell by three percentage points to 26 per cent in March

- This is down from 27 per cent in January and 29 per cent in February

- The number of sales agreed stayed the same in March – with an average of eight recorded per branch.

Mark Hayward, Chief Executive, NAEA Propertymark said:

“Earlier this month, Zoopla research2 showed that on average, houses are being sold for almost £25,000 less than asking price, which our findings echo. A record number of properties sold for less than asking price in March, indicating that buyers have shifted into the power seat. This is music to house-hunters’ ears – especially first-time buyers. Although sales to the group have fallen, the fact that the market is moving in the favour of buyers may trigger an upward swing in the number of sales agreed as they’re in a position to negotiate lower prices.

“However, this is a short-term triumph for buyers. Although demand has cooled off over the last few months and created these market conditions, it’s likely to increase again as those holding off on making purchases move to take advantage of these lower prices. Ultimately, this means the number of offers accepted below asking price will fall again and the market will swing back in the favour of homeowners. The only thing which will offer a long term solution is more homes to balance the issue of supply and demand.”

1 All figures from NAEA Propertymark’s March Housing Report – full NAEA Propertymark March Housing Report available on request

2 https://www.telegraph.co.uk/property/uk/sellers-forced-cut-asking-prices-25k-housing-market-cools/

Kindly shared by NAEA Propertymark